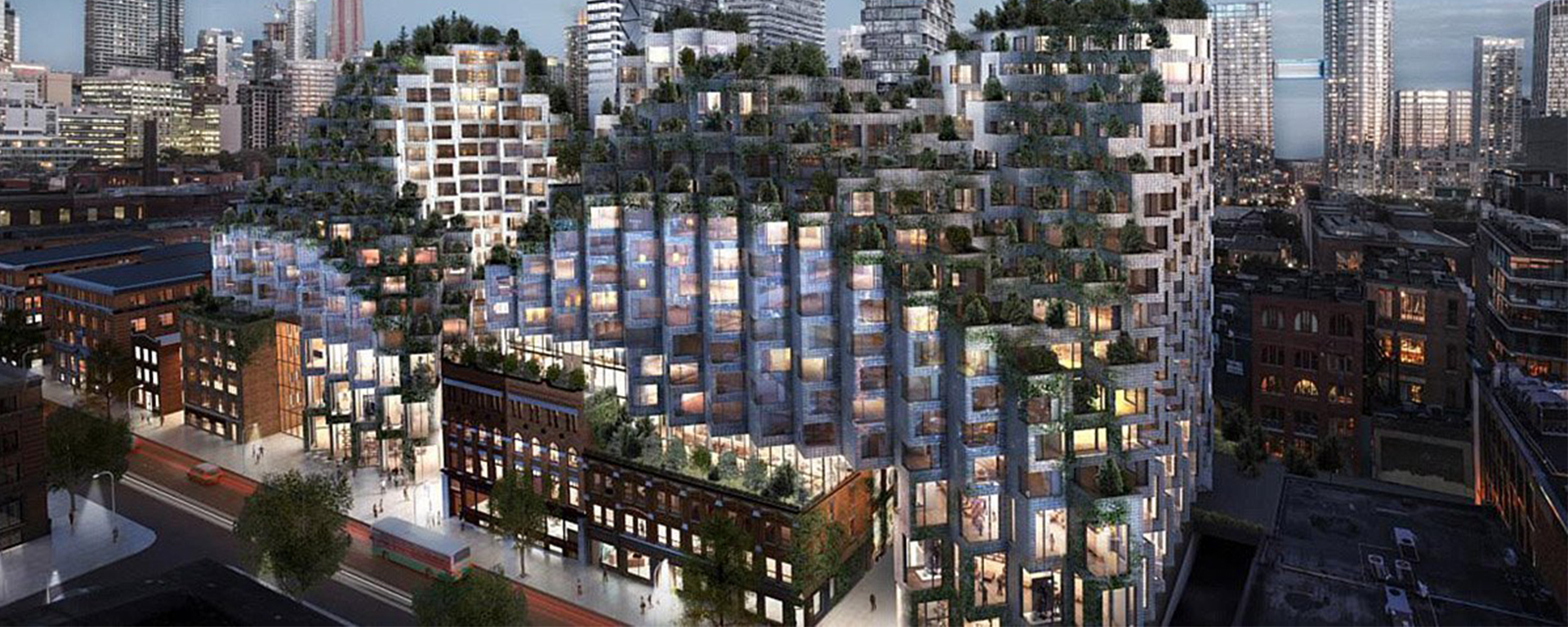

The condominium market is on fire, especially in the major urban centres in the Canadian real estate market. After a deep decline in the first year of the coronavirus pandemic, driven by evolving consumer trends, the condo market has enjoyed an exceptional turnaround. Some housing market analysts think that 2022 could even be a record-breaking year for condo sales and prices. If you have been in Toronto or Vancouver, you will likely notice a crane on nearly every corner of the downtown core, and many more condo developments outside the city centre. With more condos being built, more prospective homebuyers are taking a closer look at pre-construction condos. Many developers enable this, too, by offering a wide range of perks and discounts. But is this a reasonable buying decision in today’s red-hot real estate market? Let’s explore this sector.

Pre-construction condos can be an excellent investment. At the same time, there are still pros and cons to buying before shovels are in the ground that many homebuyers are unaware of today.

#1 Down Payment

Is it impossible to scrape together enough of a down payment to purchase a residential property in this sizzling housing market? While studies show that it is taking longer for households to put together a down payment for a home, pre-construction condos are a way for some buyers to get their foot in the door as they continue to save their down payment prior to closing, which can be a few years away.

Although you still need about 20 per cent as a down payment for a condominium, you only need to pay it off over a four-year period. This is highly beneficial for middle-class families who may find themselves struggling to buy property.

#2 No Bidding Wars

Because many units are available for purchase before the project starts, you do not need to engage in cutthroat bidding wars that add obscene premiums to the asking price. This strategy has become all too familiar in the Canadian real estate market, however pre-sale condos don’t typically experience these conditions since buyers take on some level of risk in purchasing a suite that isn’t built yet. Bidding wars are much more common on the resale market.

#3 Very Little Maintenance

What is better than that brand-new shine? Be it a new kitchen appliance or a new automobile, getting something that has never been used before is great. Many Canadians don’t experience this on the resale market, but it’s a huge benefit of buying a pre-construction condominium, complete with countertops, floors and even balconies that have never been touched before.

As a result, very little maintenance is required, meaning you can save money in the short term. If you take good care of your abode, any additional maintenance costs may be far off in the future.

#4 Values Appreciate Before Moving In

Let’s say you buy a pre-construction condo suite for $500,000. Judging by part performance of the housing market, including condominiums, it is possible that your unit could be worth considerably more by the time you move in. If that is the case, you will enjoy immediate equity. Of course, the opposite may also come to pass, much like when some people bought at the top of the market just before the public health crisis really set in.

#5 Cooling Off Period

According to Section 73 of the Condominium Act, homebuyers are given a 10-day cooling-off period from the start of the agreement to purchase a pre-construction condo. So long as you provide written notice, you can get out of the contract and move on from the property if you have second thoughts.

#1 Long Wait Times

Once you sign the agreement and provide the initial down payment, it could take as long as four to five years before you get the key to your new unit. If you are purchasing a condo in a 40-story building, you will need the patience of a saint because you will have a few more years to wait until everything is ready.

#2 Sales Tax

Today, there is no sales tax on a resale home. However, there is a harmonized sales tax (HST) for pre-construction buildings because these units are brand new. While you are not paying a separate amount, the HST and the HST rebate will be factored into the price. You will need to calculate the amount.

#3 Added Closing Costs

Closing costs will run between 1.5 and three per cent of the purchase price of a resale home. However, for pre-construction condos, it can be more. Your real estate attorney should examine the contract and associated costs with a fine-tooth comb.

Canada is desperate for one thing: housing supply. Many real estate experts agree that greater inventory levels are the most effective antidote to today’s sky-high prices, no matter what laws are passed or how much interest rates are raised. Without more housing stockpiles, prices will sustain their upward trajectory, especially as demand continues to strengthen across the country.

Whether condos will address this issue or not remains to be seen, but pre-construction builds are popular for many middle-income households and investors for a reason.